Shopping for auto insurance? Here’s a few tips to help you be a better shopper

Are you shopping for auto insurance? Many customers are lured in by low prices offered by agents over the phone. Unfortunately, most of those prices are phony. Become a more sophisticated shopper by applying a few tips that I suggest for you:

- Have a “baseline” – a set coverage that you want to be quoted at. You could get a quote with a company that is offering you one level of coverage, while another will give you a quote based on a different level of coverage. Essentially, make sure to compare “apples to apples”. You will obviously get a lower price when you get quoted lower coverage.

- Be wary of anyone that offers you a quote and does NOT ask you about your driving record. Your driving record is a major factor in determining the price. Usually agents that don’t ask questions about your driving record are only interested in getting you in the office by offering you the lowest quote possible, and use a bait and switch tactic, by not offering you an “honest” quote. Other questions that should be asked is marital status, commute miles, & occupation.

- Although the purpose of shopping around for your auto insurance is to get the most for your money, please always remember that you get what you pay for. There are various companies out there that you have never heard of that offer really low rates, excellent coverage, but extremely bad service, whether it be customer service or service during a claim. There are always exceptions, but “brand” companies tend to work harder to keep their brand’s reputation as good and clean as possible.

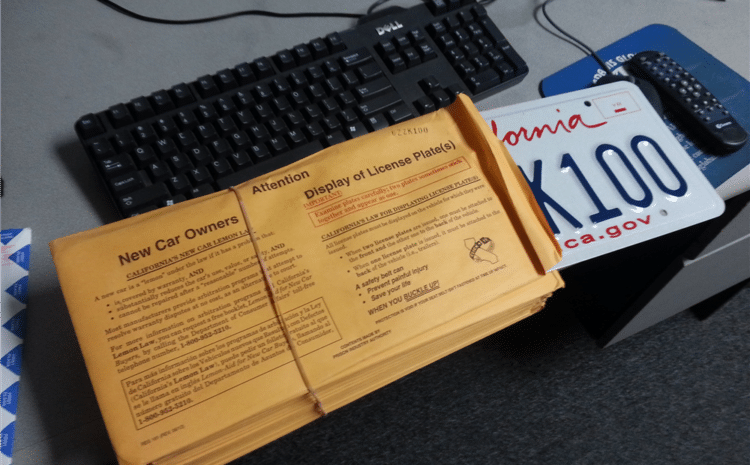

- When and where possible, give the salesperson your driver’s license number, and the VIN (vehicle identification numbers) for your vehicles. This will ensure a more accurate quote, because a VIN will tell the agent exactly what vehicle they are dealing with, and also, your motor vehicle report will ensure that they know what is on your driving record.

Use these tips to narrow down the good brokers/agents from the bad. Also, these tips will give the person on the other side of the phone the impression that you know your stuff, and this will likely lead them to take you more seriously and not use their “tricks”. Lastly, it helps you achieve your goal: to get the best rate possible based on the same information you provided. Give us a call, and let ME quote YOU :).